Social Factor snippets

Net Zero Sum Game, pension fund politics, voting rights snippet, bonkers investment commentary

Net Zero Sum Game

Here’s something I left out of the recent presentation on populism and Responsible Investment that fleshes out the point about the turf on which future fights are likely to be held. I don’t think Reform UK or the Conservatives are going to go for outright climate scepticism, they will focus on trade-offs.

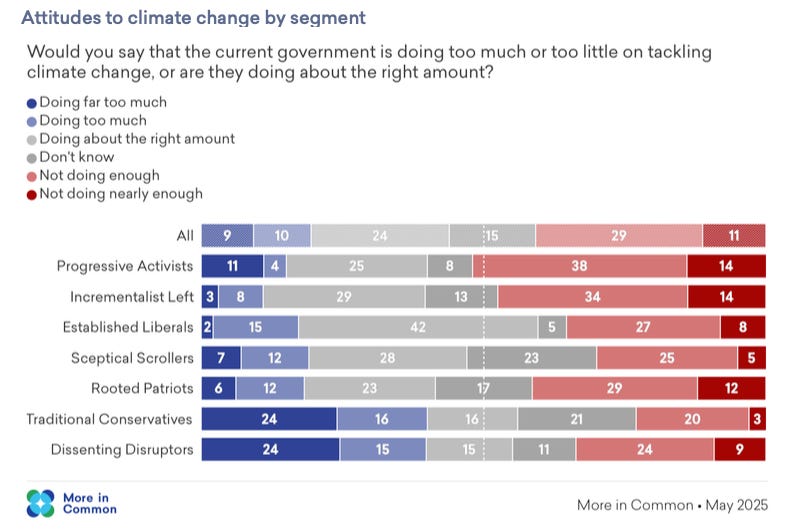

These charts are taken from the excellent Shattered Britain report.

A lot of people have internalised a view that there is a strong consensus in favour of action that hasn’t actually been won / tested yet. I think they focus on the red bars in the first chart and the blue bars in the second. I see a lot of light red/blue and a lot of grey. I can understand why parties on the Right think there’s a fight to be had here. I would not waste time preparing for a fight on science, it’s going to be all about trade-offs - jobs, energy costs, security of supply.

Pension fund politics

Relatedly, I continue to spend my spare time listening to discussions of ESG issues taking place where Reform UK are involved. I do not think there is a concerted move nationally by the party as yet (I suspect they may focus more on costs), but questions from councillors are coming up fairly regularly from what I can see.

I had a slide in my populism deck about the potential squeeze on stewardship.

In one committee meeting I watched recently, a Reform councillor raised a sceptical question about climate change while left-of-centre councillors asked about exposure to the Israel/Palestine conflict.

That’s the squeeze I flagged: under fire from both directions. Too political for one flank, not political enough for the other.

Voting rights snippet

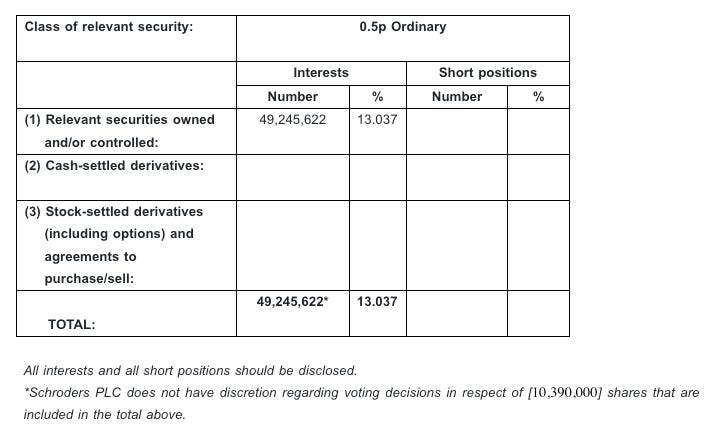

I’ve previously covered voting rights disclosures made by BlackRock and suggested that language about lack of voting authority might show the impact of pass-through voting. Now I’ve dug into this a bit more, I have found disclosures by other managers, though these disclosures are not across the board.

Below is a chunky one from Schroders. It has a big (13%) position in ME Group, but control of 2.75% of the total voting rights lies elsewhere.

My gut feeling is this is could be a large asset own client that has a segregated portfolio and wants to direct its own voting.

Bonkers investment commentary

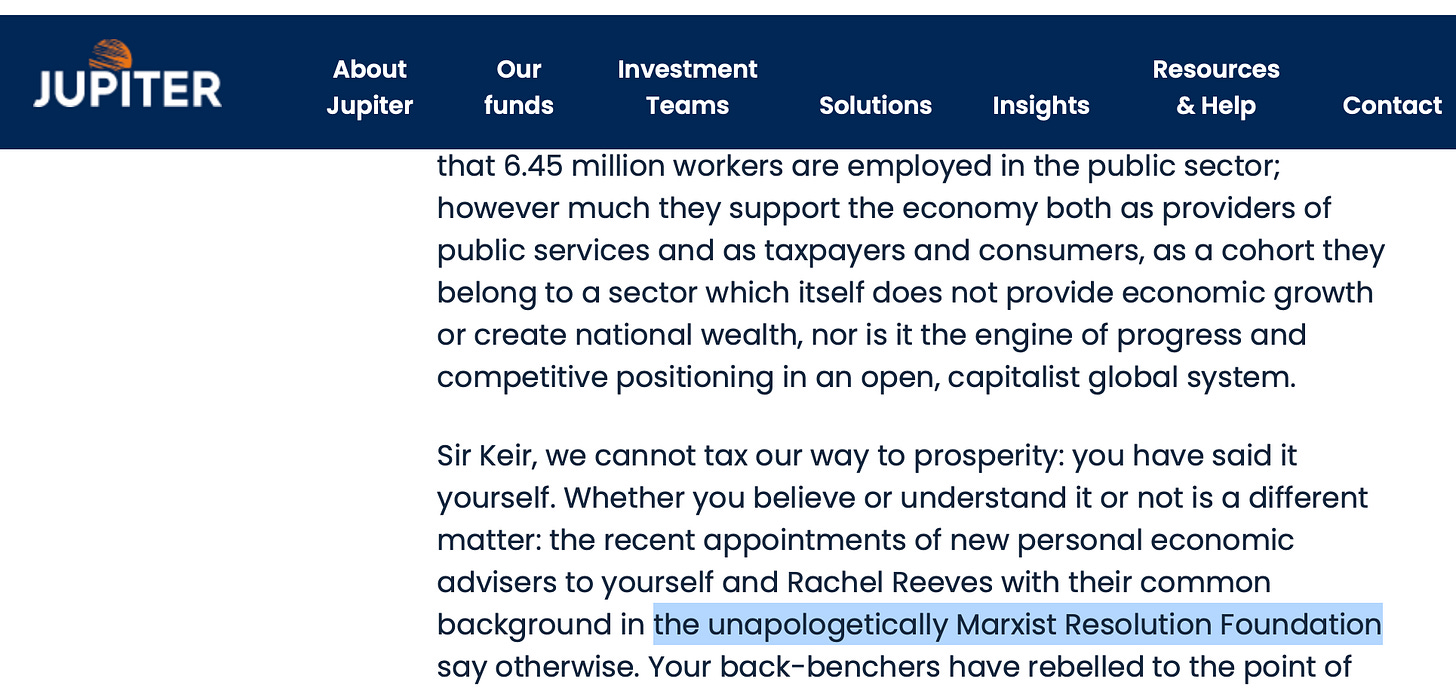

It’s rare to see asset managers take explicitly political positions. Even when they have pretty clear views these are typically laden with euphemisms. The exceptions to the rule tend to be founders of small boutiques or hedge funds who don’t have people around them asking (or allowed to ask) “are you sure this is a good idea, boss?”

So it is refreshing to read some unrestrained bonkers stuff in the Merlin Weekly Macro newsletter. I don’t know the Merlin people at all, but they now sit under Jupiter from what I can see. The Merlin Weekly Macro newsletter has frequently delved into politics - a few snips below. Calling the Resolution Foundation “unapologetically Marxist” is a particular fave.

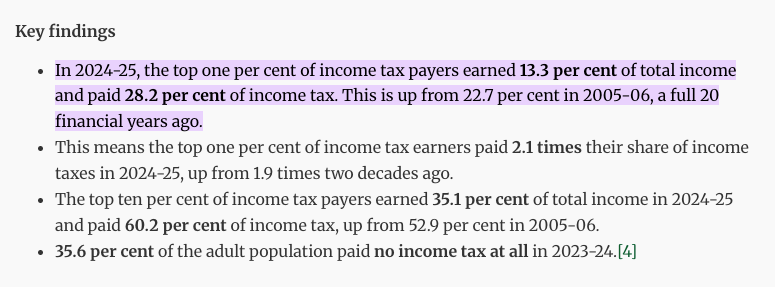

The last snip is on taxation. Some of the content looks pretty similar to a TaxPayers Alliance briefing from last year.

It’s unusual and oddly revealing. When market commentary starts to echo the culture-war language of political think-tanks, it’s potentially a sign of how porous the boundaries between finance and politics have become.